New Jersey provides residents with an opportunity to live comfortable lifestyles. Nestled between the desirable urban centers of New York and Philadelphia, New Jersey offers a diverse range of ethnicity, culture, and living in both its suburban and urban communities. However, that added value comes at a great cost to its residents in high property taxes and real estate costs. New Jersey is known to be one of the wealthiest states in the United States with home prices increasing by 8.7 percent in the past year, compared to the 8.3 percent nationally according to Zillow Q2 2018 seasonally adjusted home value data. It’s expensive to live here, and many are struggling to hold onto their homes and remaining in the very communities they helped build.

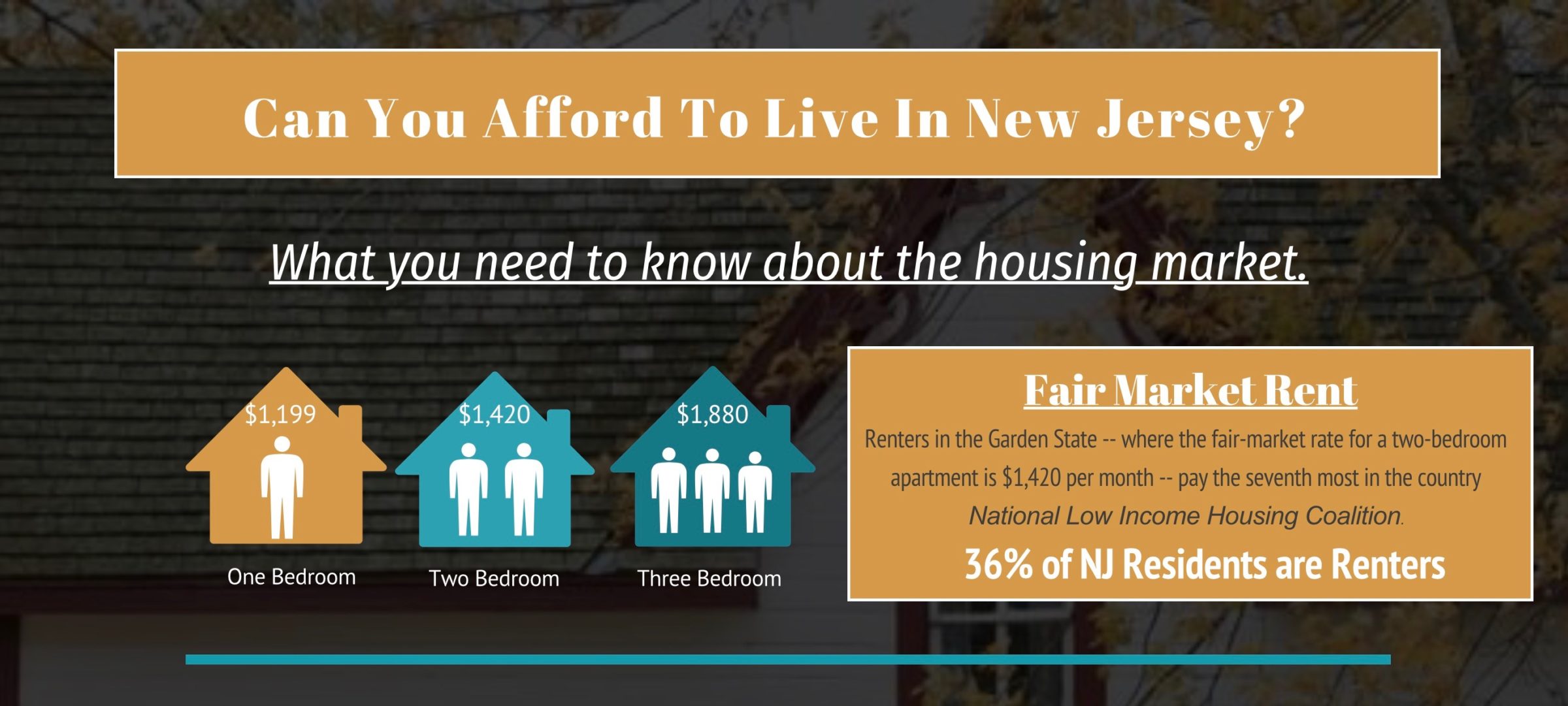

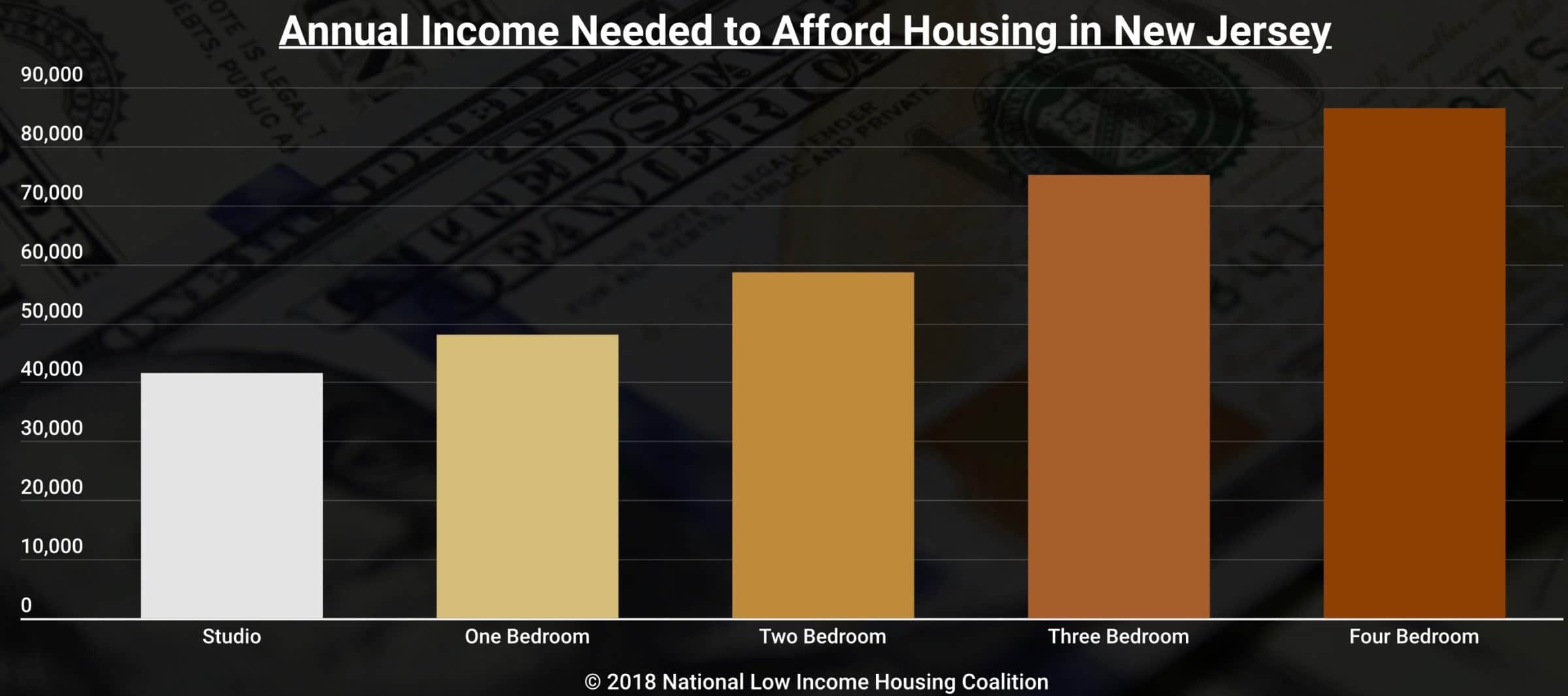

Income is offset by the rising cost of living with residents spending close to $2000 a month on housing. Renters are finding that saving for a home is becoming more challenging as the market continues to rise along with the state property tax. Currently there’s a large population of NJ residents who spend 30% of their income on housing. The National Low-Income Housing Coalition states that in order to sustain even a two-bedroom apartment, the annual wage needed to afford it is $58,603 without feeling overburdened. Over the past year, we have seen rent cost rise above 3 percent, which represents a $45 per month increase. In order to sustain, a renter must make $1 per hour on top of their salary in order to cover it. Minimum wage-earning residents are left out of the equation when it comes to renting. Unless their housing is covered by a state-ran program that provides affordable housing, minimum wage earners would have to work at least 131 hours per week just to afford a modest two-bedroom apartment. Even though some parts of New Jersey are more expensive than others, residents who do not have the luxury to save or move are forced struggle.

On The Rise feature video about the housing market

Real Estate Agents and brokers in New Jersey most populous areas are feeling the wrath of the rising market. Austin Smith, real estate agent of Essex County feels that some cities over others are experiencing factors that are beyond the control of long-time renters. Downtown Newark and different parts of low-income areas are seeing new developments with private investors making changes in favor of growth. The drawback from the developing growth is what happens to the people who are not in the developing plans. Currently New Jersey does not have rent control rules resulting in landlords having full range to upcharge and even add extra fees. Since the year 2000, rents have increased by 20 percent while wages dropped by 10 percent according to 2017 Rutgers report. The protections for residents who earn less are an afterthought, which has prompted residents and activists petitioning the council in order to make changes in the favor of the vulnerable. According to Census data, there’s hardly any wiggle room as renters aren’t able to move freely without the difficulty of finding housing that aligns with their budget. Some newly built luxury apartments offer affordable housing based on income but there aren’t enough to include the large population of 20,000 households who pay more than 50% of their income on rent.

Mortgage Banker, Chris Bower has dealt with challenges from residents who want to own a home or even move out their current home. He is noticing that prospective buyers are becoming outbid on multiple houses in desired townships. Chris says that the demand has outpaced the supply in the housing market since there is too little inventory in particular areas. Another problem prospective homebuyer’s encounter is the rising property tax. Overall, New Jersey taxes are amongst the highest in the nation currently topping 8.97 percent. Some counties are paying as high as $11,000 a year on property taxes alone which also factors in home value percentage. Real Estate Tracker ATTOM Data Solutions confirmed that Bergen, Essex, Morris and Union County have a higher than average tax rate on a national level. Homeowners must take account on how this will financially affect them since taxes are adjusted on a yearly basis.

Lack of Accountability Contributing to the Homeless Population

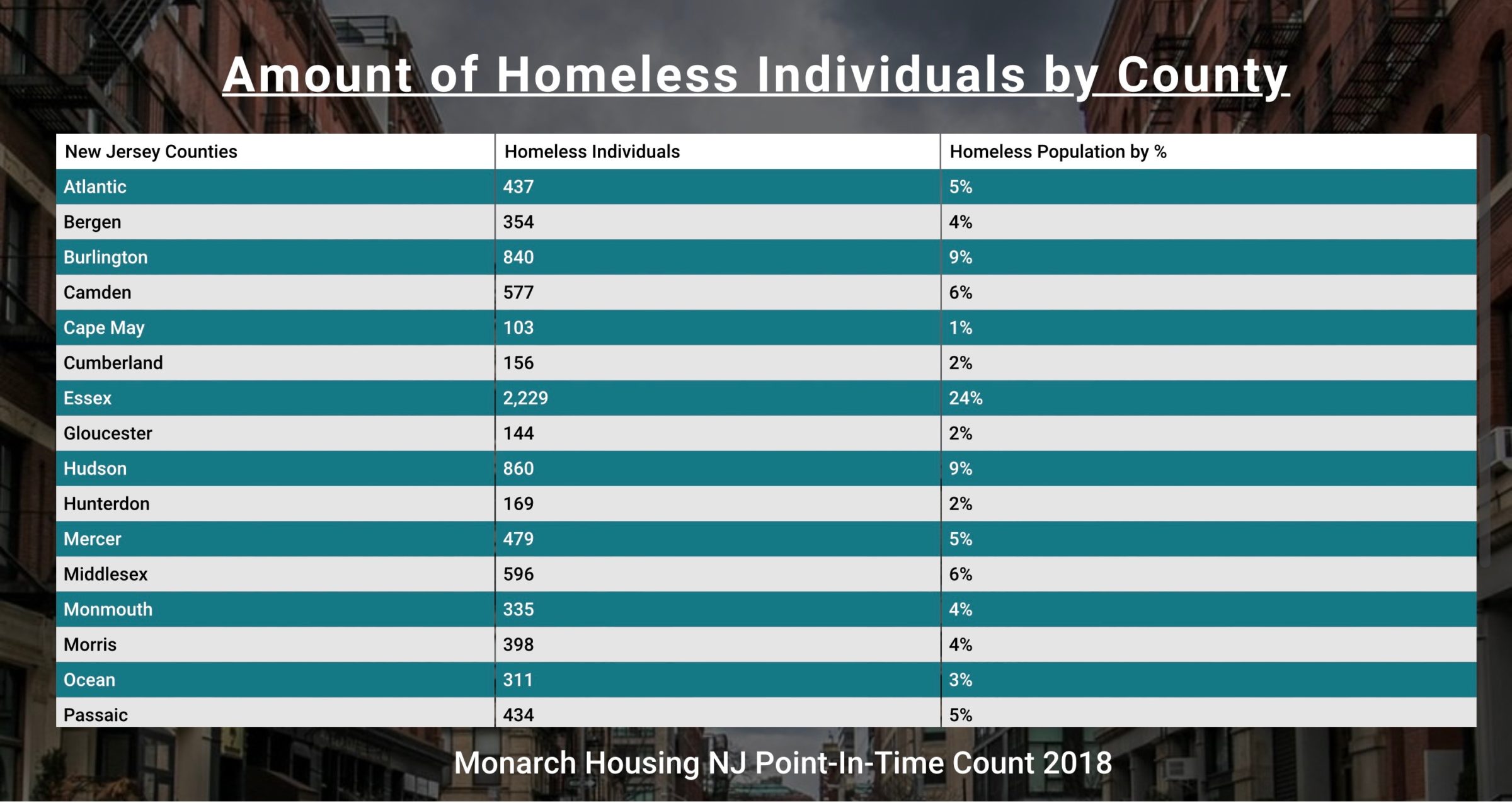

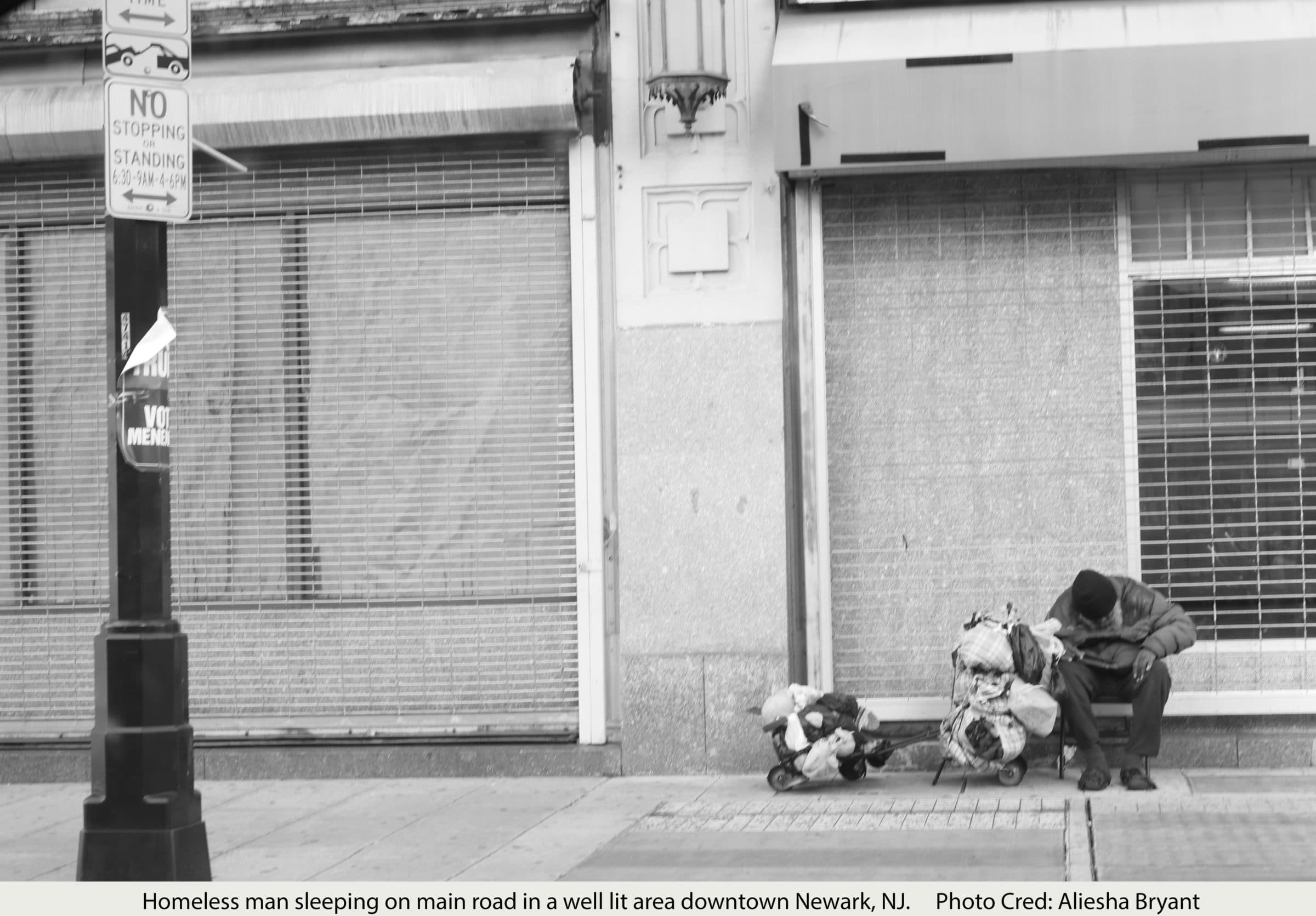

The current living situation in New Jersey has caused some into losing their homes. Research from the Good Rescue Mission shows that in Essex County at least 42% of the population has been homeless for more than one year and the top two reasons for that was either eviction or loss of job. Since many people are using a large percentage of their income to sustain housing, it becomes difficult to save money for emergency purposes. There are many organizations that help residents who have become displaced due to the housing crisis. Joi’s Angels, a non-profit located in East Orange, NJ helps the less fortunate by providing food, shelter and counseling sessions. Lorraine Ebron, Administrative Assistant of Joi’s Angels believes that there are mechanisms residents can use in order to prevent homelessness. New Jersey Point-in-Time Report found that African Americans make up 48.1% of the homeless population. New Jersey happens to rank 12th-highest in the nation for income inequality according to the latest 2012-2016 Census data. As the result, African Americans are losing their homes at a disproportionate rate. It’s becoming harder for residents with middle to low income to withstand the course of economic changes. Equal opportunities for working residents should be placed at the forefront and policy makers should be held accountable for fixing the housing crisis.

Aliesha Bryant

Senior Communications & Media Arts Major

Aliesha Bryant is a senior from Montclair State University majoring in Communications & Media Arts. Her creative resume consists of filming and video editing. She aspires to work in digital media and contribute her skills to make visually captivating projects.

https://infogram.com/new-jersey-housing-1h7z2ll5pmne2ow?live

https://infogram.com/new-jersey-housing-1h7z2ll5pmne2ow?live

https://infogram.com/untitled-dashboard-1h7z2llevgqy2ow?live

https://infogram.com/untitled-dashboard-1h7z2llevgqy2ow?live